Get the free pay stub template with calculator excel

Show details

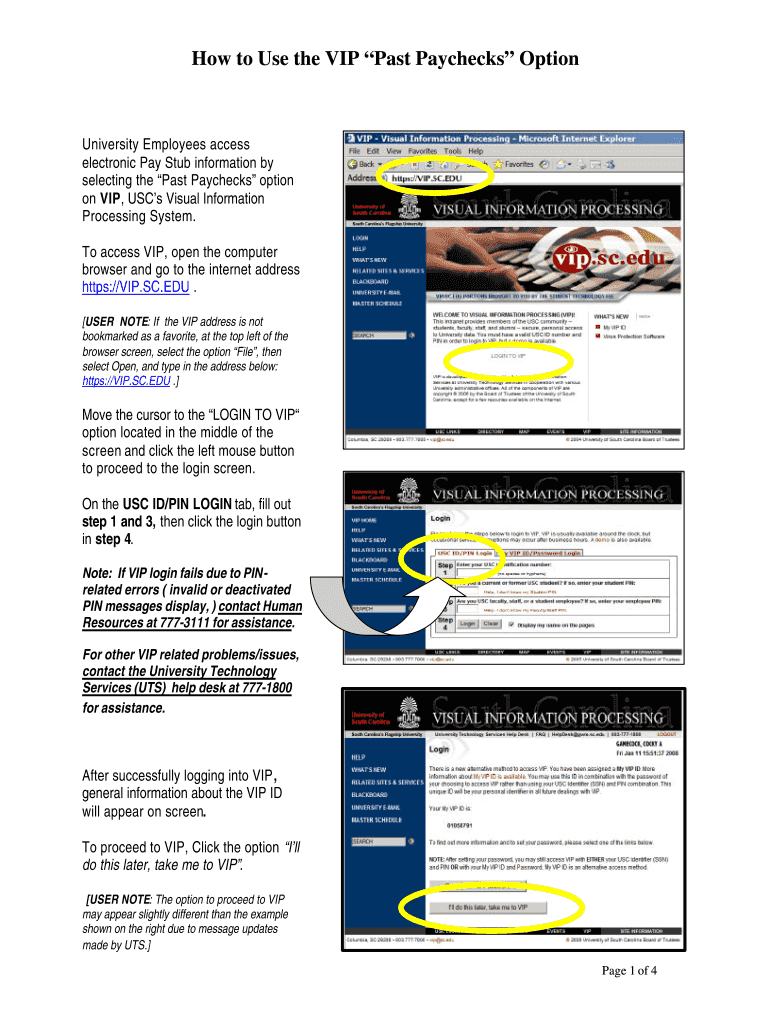

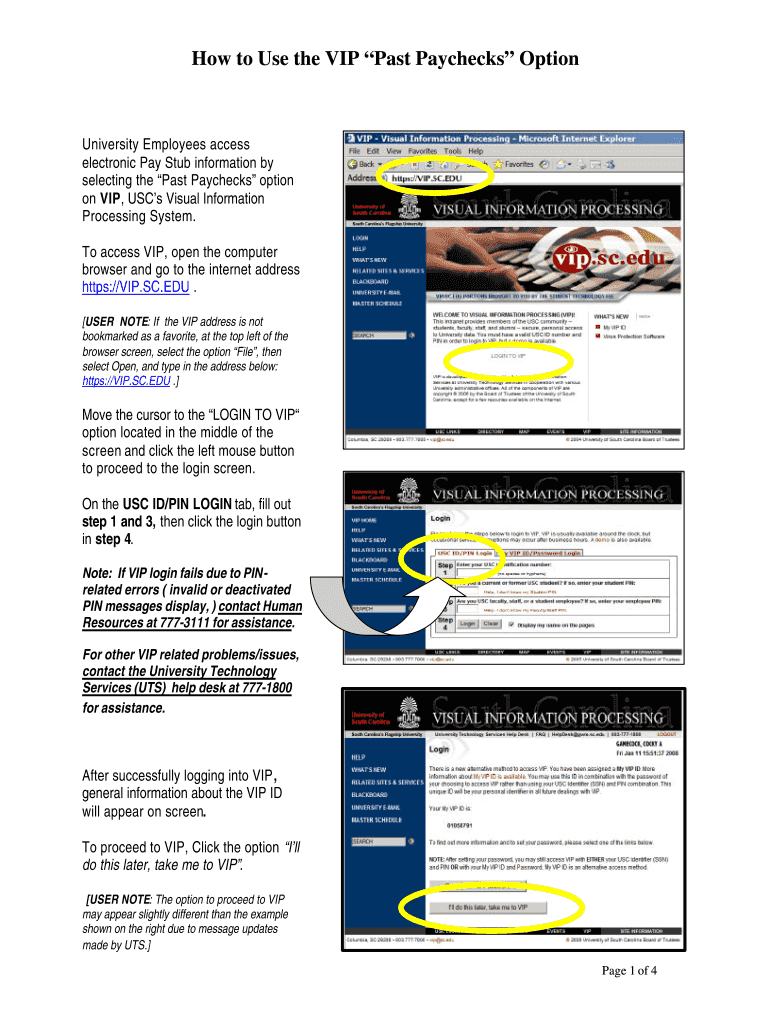

How to Use the VIP Past Paychecks” Option University Employees access electronic Pay Stub information by selecting the Past Paychecks” option on VIP, USC's Visual Information Processing System.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pay stub template with calculator form

Edit your excel pay stub template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pay stub template excel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit excel paystub template online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit can you make a pay template will calculate the totals form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out paystub template for excel form

Point by point, here is how to fill out a pay stub template and who needs it:

How to fill out pay stub template:

01

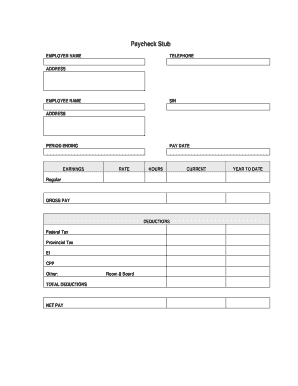

Gather necessary information: Collect all relevant information, such as employee name, address, social security number, pay period dates, and employment details.

02

Calculate earnings: Determine the employee's gross salary or hourly wage and calculate any overtime, bonuses, commissions, or other additional earnings.

03

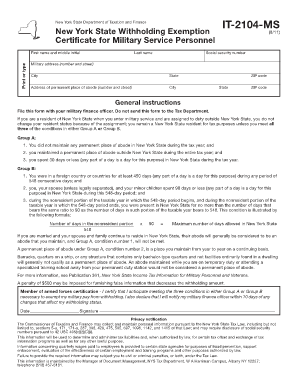

Deduct taxes: Determine and deduct federal, state, and local taxes from the employee's earnings based on the applicable tax rates and allowances.

04

Subtract other deductions: Subtract any other deductions such as health insurance premiums, retirement contributions, or other company-specific deductions.

05

Calculate net pay: Subtract the total deductions from the gross earnings to calculate the net pay, which is the amount the employee will receive.

06

Fill in the pay stub fields: Enter the employee's name, address, pay period dates, and all the calculated figures into the corresponding fields on the pay stub template.

07

Include additional details: Add any additional information, such as the employee's hours worked, vacation or sick leave taken, or any other relevant information that may be required by the company.

Who needs pay stub template:

01

Small business owners: Small business owners can use pay stub templates to accurately record and provide payroll information to their employees.

02

Employers: Employers of any size can utilize pay stub templates to document and communicate the details of their employees' earnings and deductions.

03

Employees: Employees can benefit from pay stub templates as they provide a clear breakdown of their earnings, deductions, and net pay, ensuring transparency and a record of their income.

Fill

pay stub template with calculator no watermark

: Try Risk Free

People Also Ask about payroll stub template excel

Is it legal to make your own pay stubs?

It is perfectly legal to create your own pay stubs, and you can do so easily using Check Stub Maker. However, creating pay stubs in order to apply for loans and other things is illegal.

Can you make a pay stub on Excel?

If you need a pay stub template with detailed hourly data, this Excel option shows an itemized list of hours worked and hourly rates based on the type of shift completed. Enter the type of hours worked, number of hours, and pay rates, and the template will calculate the totals.

How do you fabricate a pay stub?

How to make a pay stub for your employees Start with the employee's total gross pay for the pay period. Add deductions for taxes withheld (federal, state, and local if applicable, as well as FICA). Deduct the employee-paid portion of health insurance premiums. Deduct employee-elected retirement plan contributions.

How do I make my own paystub?

How to make a pay stub for your employees Start with the employee's total gross pay for the pay period. Add deductions for taxes withheld (federal, state, and local if applicable, as well as FICA). Deduct the employee-paid portion of health insurance premiums. Deduct employee-elected retirement plan contributions.

Does Microsoft Word have a pay stub template?

To help you craft the perfect direct or ePay stub, download one of our premium Pay Stub Templates. You can easily edit our templates in all versions of Microsoft Word. Our files are ready-made and 100% customizable to suit your preferences. This professionally-written template isn't just limited to a computer.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the fillable pay stub pdf electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your pdffiller in minutes.

How can I edit fillable pay stub excel on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing how to make pay stubs with excel, you need to install and log in to the app.

How do I complete pay stub template with calculator pdf on an Android device?

Use the pdfFiller mobile app and complete your paystub generator with calculator and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is pay stub template with?

A pay stub template is a document that outlines an employee's earnings and deductions for a specific pay period. It typically includes details such as gross pay, net pay, taxes withheld, and other deductions.

Who is required to file pay stub template with?

Employers are generally required to provide pay stubs to their employees, and in some jurisdictions, they may also have to file copies of these pay stubs with relevant government agencies.

How to fill out pay stub template with?

To fill out a pay stub template, enter the employee's personal information, including name and address, the pay period dates, gross earnings, deductions, and net pay. Ensure to provide clear calculations for taxes and other deductions.

What is the purpose of pay stub template with?

The purpose of a pay stub template is to provide a clear record of payment details to employees, ensuring transparency in earnings and deductions, and serving as a crucial document for financial tracking and tax purposes.

What information must be reported on pay stub template with?

A pay stub template must report the employee's name, address, social security number, pay period dates, gross wages, deductions (including taxes), and net pay. Any bonus or overtime should also be listed if applicable.

Fill out your pay stub template with online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pay Stub Template Excel Download is not the form you're looking for?Search for another form here.

Keywords relevant to check stub template with calculator

Related to how to create a pay stub using excel

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.